tax shield formula dcf

Double counting of Tax shield and free cash flow. The formula includes that comes from tax shield savings.

Tax Shield Formula Step By Step Calculation With Examples

There is no exact answer for.

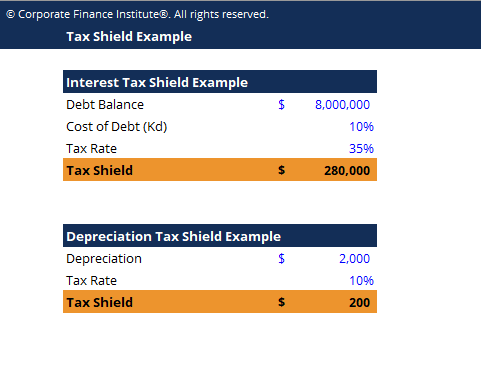

. Its 50000 debt load has an interest tax shield of 15000 or 50000 30 7 7. Interest Tax Shield Interest Expense Tax Rate For instance if the tax rate is 210 and the company has 1m of interest. Concerning DCF there are three widely used methods to calculate the present value of a company.

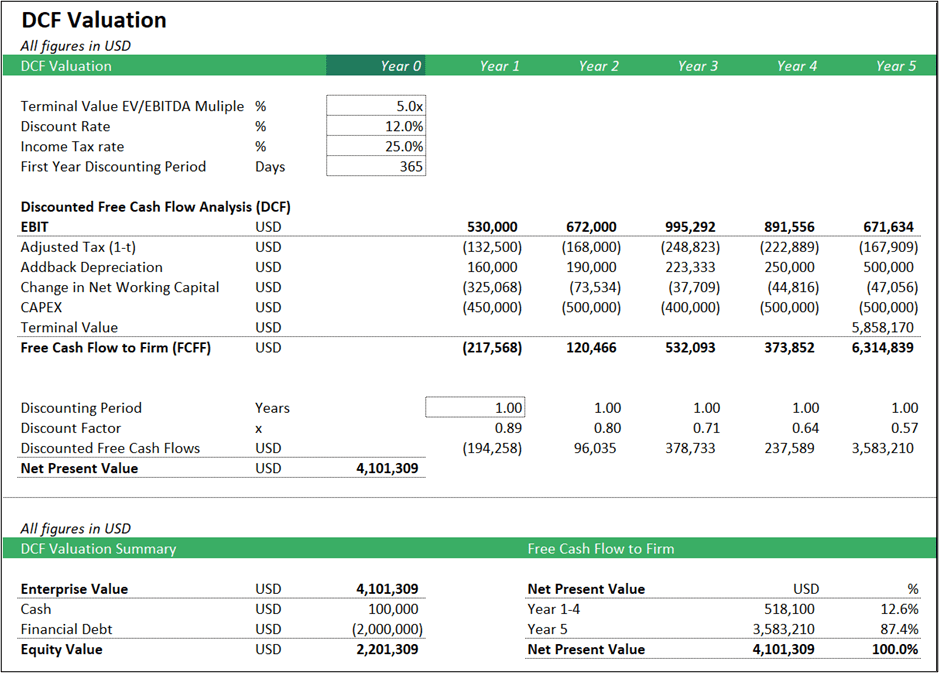

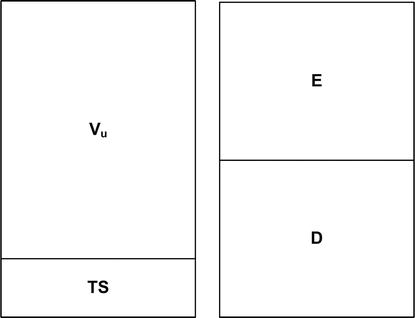

The discounted cash flow DCF formula is equal to the sum of the cash flow in each period divided by one plus the discount rate WACC raised to the power of the period. However when converted the lost tax. The DCF valuation of the business is simply equal to the sum of the discounted projected Free Cash Flow amounts plus the discounted Terminal Value amount.

Thus the adjusted present value is 115000 or 100000 15000. - Capex - WC. The formula for calculating the interest tax shield is as follows.

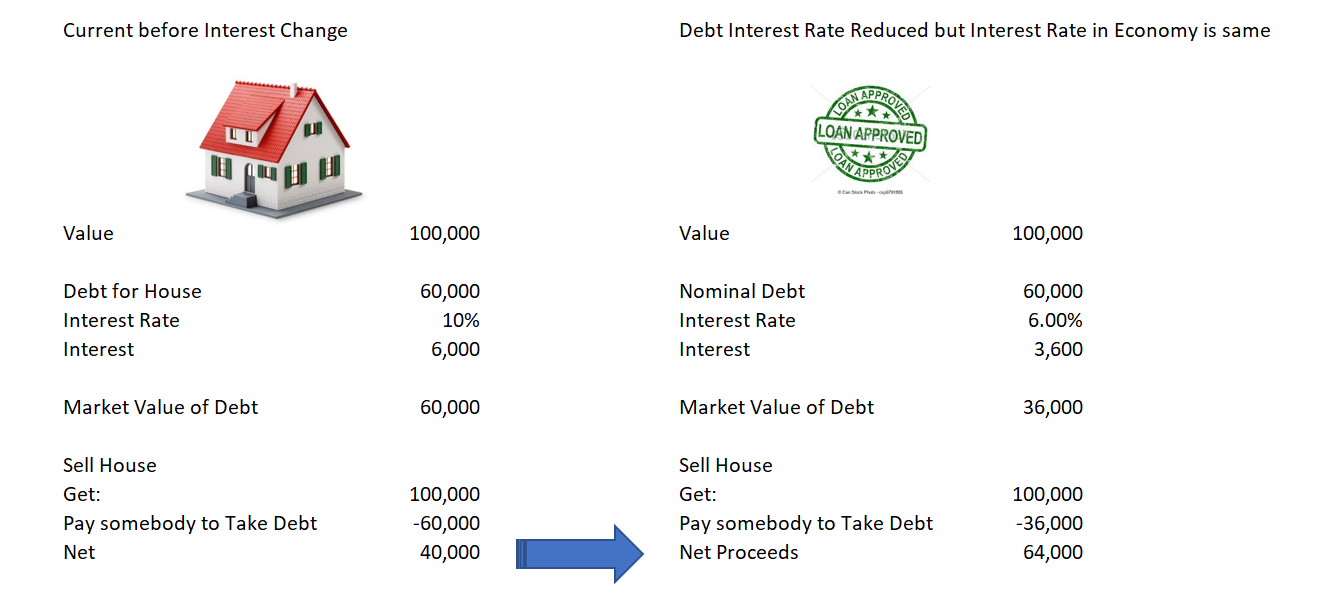

My understanding is that interest. The cost of debt is the marginal cost of debt after giving effect to the tax shield provided by debt financing K d Outstanding Debt Marginal Interest Rate. Consider Tc20 and the convertible bond will pay out an 800000 coupon.

The flows to equity method. Hi Friends FCF EBIT 1-Tc Depr. FCFFa EBIT 1-tax rate Non-Cash Charges Depreciation - Working Capital investments - Fixed capital investments Or rewriting in a short way using abbreviations.

If the bond were not converted the tax savings would have been 100000. The standard WACC approach. And stand for debt and equity of the firm and are the required return rates for debt and equity is the marginal.

Depreciation Tax Shield Formula Depreciation Tax Shield Depreciation Expense Tax Rate If feasible annual depreciation expense can be manually calculated by subtracting the salvage.

Tax Principles Part 2 Valuing Nols Multiple Expansion

Tax Shield Definition And Formula Bookstime

Tax Shield Definition Example How Does It Works

Tax Shield Formula How To Calculate Tax Shield With Example

Tough Outdoor Supplies Is Looking To Expand Its Chegg Com

Using Apv A Better Tool For Valuing Operations

The Present Value Of The Tax Shield Download Scientific Diagram

How To Npv Tax Shield Salvage Value Youtube

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Dcf Model Method Discount Cash Flow Valuation Example

Wacc Adjustment To Correct Valuation Of Tax Shields Edward Bodmer Project And Corporate Finance

Constant Leverage And Constant Cost Of Capital A Common Knowledge Half Truth

Understanding The Weighted Average Cost Of Capital Wacc By Dobromir Dikov Fcca Magnimetrics Medium

Tax Shield Example Template Download Free Excel Template

Tax Shield Formula Examples Interest Depreciation Tax Deductible Wall Street Oasis

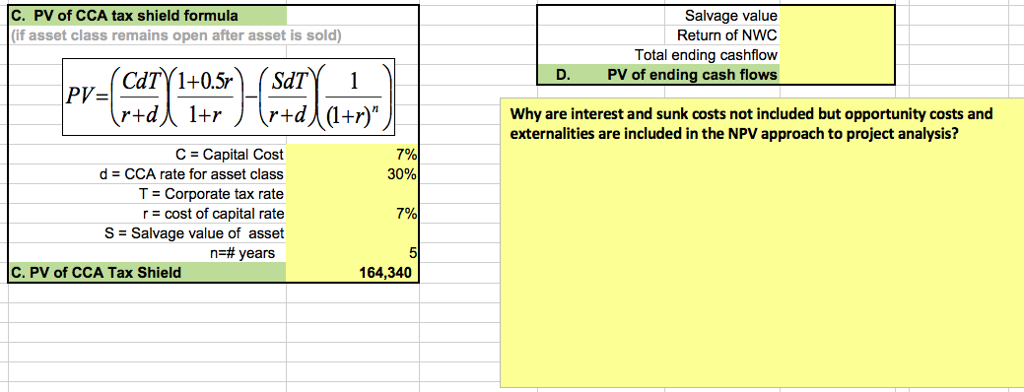

Present Value Of Tax Shield On Cca Evaluation And Computations In Corporate Finance Lecture Slides Slides Corporate Finance Docsity

Review Of Tax Shield Valuation And Its Application To Emerging Markets Finance Intechopen

Tax Shield Formula Examples Interest Depreciation Tax Deductible Wall Street Oasis

Training Modular Financial Modeling Ii Dcf Valuations Enterprise Dcf Valuation Pre Tax Vs Post Tax Valuations Modano