are delinquent property taxes public record

For an official record of the account please visit any Tax Office location or contact our office at 713-274-8000. If payment is not received at the Tax Collectors office before June 1st a lien will be placed against the property and additional charges shall be due.

Delinquent Property Tax Letter Samples Fill Online Printable Fillable Blank Pdffiller

Every effort is made by the Stark County Treasurers Office to avoid Foreclosure proceedings to collect an outstanding balance on real estate or mobile home taxes.

. Property information may be obtained by visiting the following pages. 424 Public Square Suite 3 Columbia KY 42728. The amount due on each parcel includes costs associated with the sale interest prorated advertising as well as taxes and non-ad valorem assessments.

And maintains an accurate up-to-date account of monies collected. In Kaufman County property tax bills are sent in October and are due by January 31st. By virtue of the decree rendered by the probate court of fayette county alabama.

Tax Receipts can be found on the current statement page or by clicking. 112 State Street Room 800 Albany NY 12207. Cash Money Order Certified Check Personal checks are accepted for first year delinquents up to January 1st VISA MasterCard and Discover are.

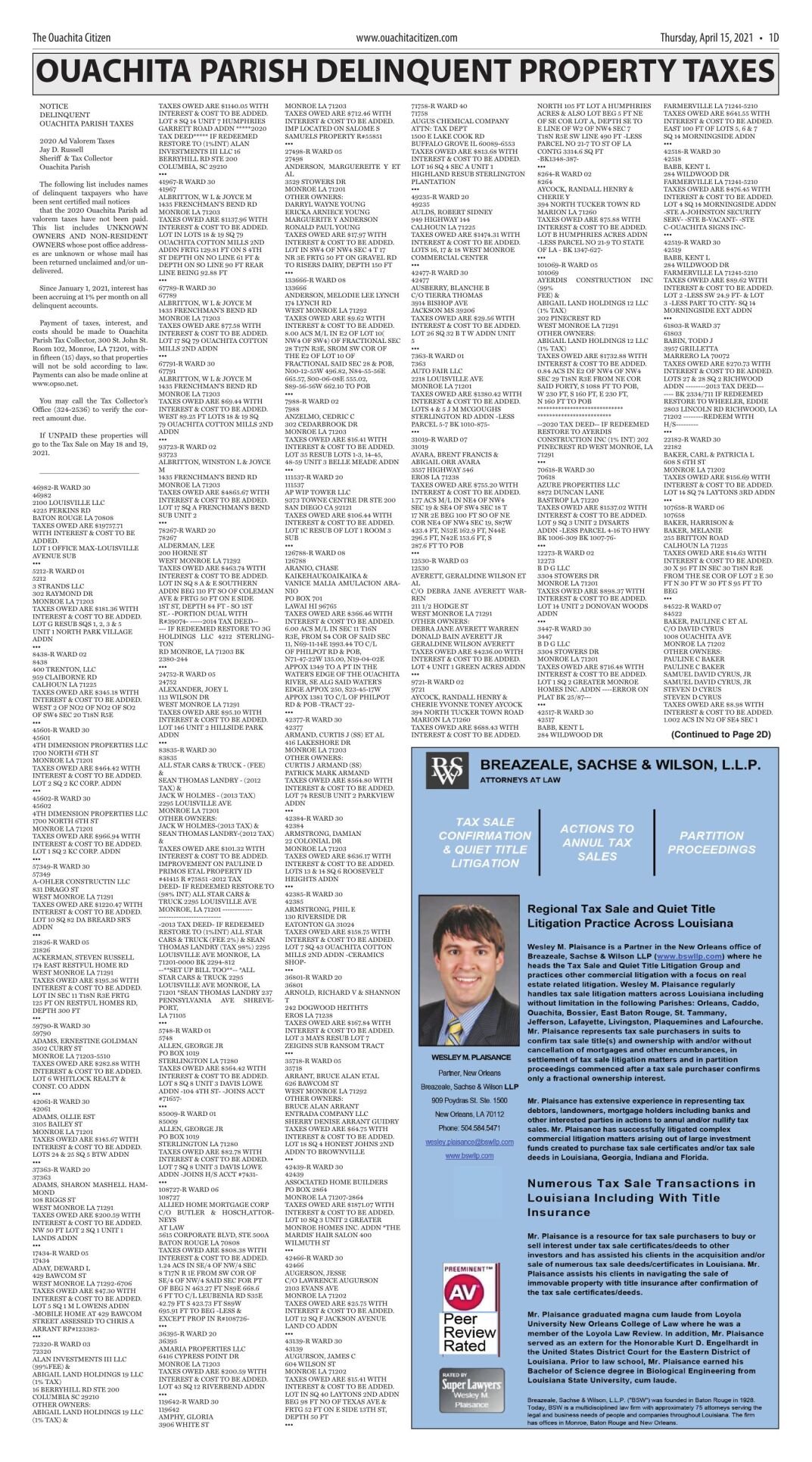

Contact for View the Public Disclosure Tax Delinquents List. In each of the examples above the county could initiate foreclosure against the real property in question after the taxes become delinquent on January 6. The real estate that is subject to the lien is listed in the name of the record owner as of the date the taxes became delinquent and the principle amount of the taxes is set out in the advertisement below.

Search Kentucky jail and inmate records through Vinelink. Although we collect the taxes we do not issue the tax bills. Please submit a REAL PROPERTY REFUND REQUEST INQUIRY FORM to report any errors in the property records or to submit questions or comments for the Fiscal Officer.

Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089. View the tax delinquents list online. When visiting the Courthouse to pay your delinquent taxes please visit the Tax Claim Bureau first.

Courthouse of fayette in. Search official records of delinquent property taxes. View information about Albany County real property auctions and county-owned property sales including list of properties.

Eventually the lien owners may have to force foreclosure on the property to pay the liens. Tax Department Call DOR Contact Tax Department at 617 887-6367. Tangible Personal Property Taxes.

9 am4 pm Monday through Friday. Delinquent tax sale notice. Free Oakland County Michigan Delinquent Property Taxes Public Records.

Delinquent tax records are handled differently by state. Phone 270384-2801 Fax 270384-4805. They will issue you a statement based on the amount you are paying.

Welcome to the Cuyahoga County Property Information Web site. Once a property tax bill is deemed delinquent after March 16th of each year a 15 past due penalty is added to the bill and the bill is sent to the Delinquent Tax Office. Top 100 Delinquent Taxpayer - This lists the top 100 delinquent taxpayers for the current fiscal year.

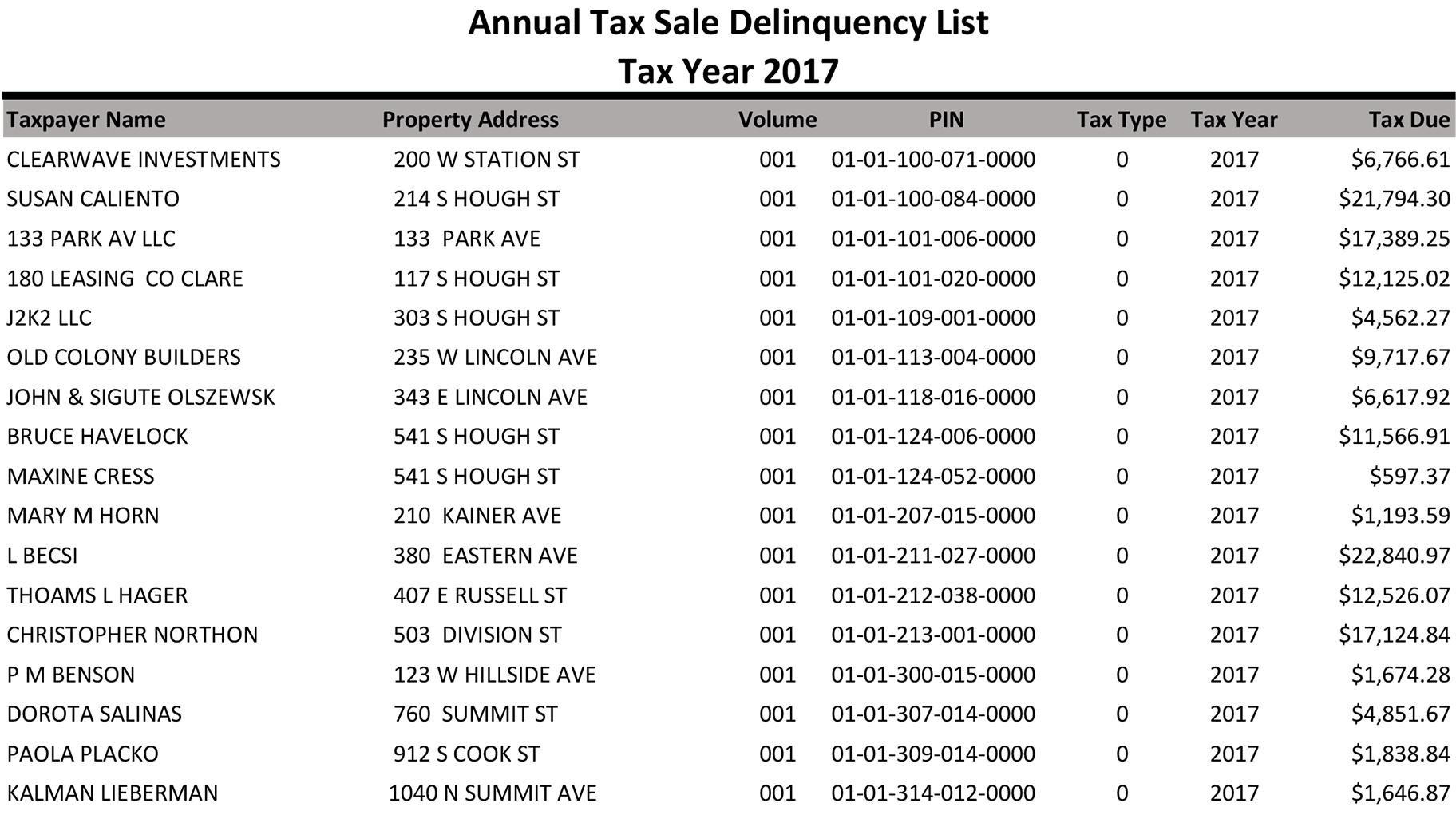

Delinquent Taxpayer Publication - This publication lists delinquent taxpayers with prior year delinquent taxes. Seminole County Tax Collector PO Box 630 Sanford FL 32772-0630 407 665-1000 Email Contacts Email Public Records Custodian. Tax sale for the 2021 tax year.

The Saginaw County Treasurer offers three ways to make your Delinquent Property Tax Payment process as convenient as possible. If the taxpayer does not set up a Delinquent Tax Contract or does not make the monthly payments andor yearly tax. The Delinquent Tax Division investigates and collects delinquent real and personal property taxes penalties and levy costs.

A 3 minimum mandatory charge and advertising charge is imposed on April 1. Search Adair County recorded land records through a paid subscription. Recorder Clerk Marriage Licenses Voter Information and Delinquent Tax Properties.

Jail and Inmate Records. The information displayed reflects the. Once a property tax bill is deemed delinquent after March 15 of each year the debt goes into execution and the County Treasurer sends the.

Interest accrues at a rate of 15 per month plus. At that point you could take possession of. The Tax Office accepts full and partial payment of property taxes online.

Our office hours are 800 am - 500 pm Monday thru Friday. If the taxpayer should fall behind a two-year Delinquent Tax Contract is available. Delinquent Taxes and Tax Foreclosure Auctions.

If left unpaid the liens are sold at auctions to the public. When delinquent or unpaid taxes are sold by the Cook County Treasurers office at an annual sale or scavenger sale the Clerks office can provide you with an Estimate Cost of Redemption detailing the amount necessary to redeem pay your taxes and remove the threat of losing your property. Property taxpayers may use credit cards debit cards or e-Checks to pay their taxes.

Kaufman County Delinquent Property Taxes. I will proceed to sell for cash in front of the. Delinquent Real Estate Taxes.

An additional 30 fee will be added to all real property bills and an additional 40 fee will be added to all mobile home bills if the taxes penalties and assessment fees are not paid by. Finds and notifies taxpayers of taxes owed. Delinquent Property Tax Search.

Remember that regardless of record ownership delinquent taxes on real property may always be collected through foreclosure on the real property itself. If the taxes remain unpaid the taxing unit will foreclose the tax liens and sell the property subject to the liens in satisfaction of its. To View ALL Notices CLICK the Search RE Button.

Typically a tax lien is placed on the property by the government when the owner fails to pay the property taxes. On February 1st unpaid Kaufman County property tax accounts begin to accrue interest and penalties starting at 7 and increasing monthly while the taxes remain overdue and possibly resulting in tax liens. The Luzerne County Assessment office collects delinquent Property Taxes.

Important Information Dates.

Statement Of Prior Year Taxes Los Angeles County Property Tax Portal

Secured Property Taxes Treasurer Tax Collector

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

Delinquent Property Taxes April 15 2021 Click To Download Pages Public Notices Hannapub Com

How To Get Delinquent Property Tax Penalties Waived Update State Covid Waiver Program Has Ended County Of San Luis Obispo

How To Find Tax Delinquent Properties In Your Area Rethority

Delinquent Property Tax Department Of Revenue

Online Credit Card Payment Helpful Information

How To Find Tax Delinquent Properties In Your Area Rethority

Notice Of Delinquency Los Angeles County Property Tax Portal

How To Find Tax Delinquent Properties In Your Area Rethority

Delinquent Property Taxes Lafourche Parish Sheriff S Office

Secured Property Taxes Treasurer Tax Collector

Delinquent Tax Deadline Looms For 45k Property Owners In Cook County Chicago News Wttw

Understanding Your Property Tax Bill Clackamas County

2020 Lucas County Auditor Delinquent Land Tax Notices The Blade

Why Posting Delinquent Tax Notices Works Palmetto Posting

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster